‘Blah blah blah …’, we know that everyone’s either talking about Brexit or MTD (Making Tax Digital) but, like it or not, they are important.

It’s worth getting up to speed with what MTD is and what it means to you, no matter how boring it might be!

So, what is MTD and why is it being introduced?

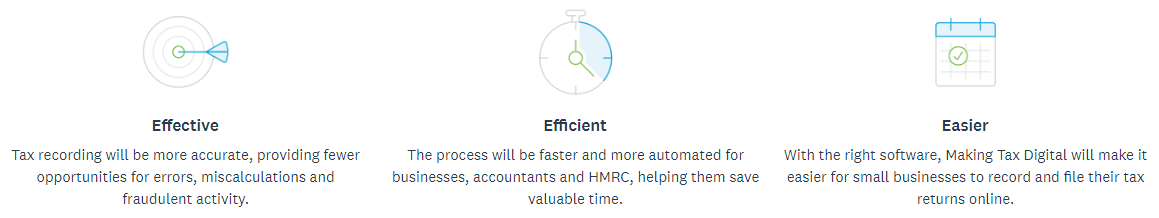

Well, MTD is an HMRC initiative designed to make sure that the UK tax system is effective, efficient and easier for taxpayers.

It is all about making the way in which we record and report taxes digital.

When does it start?

Phase 1 comes into force on 1st April 2019, initially affecting all businesses that are VAT registered. So, VAT registered businesses MUST keep digital records and submit their VAT returns via compatible software. This means that it is now more important than ever to start using Receipt Bank, which gives you the ability to snap & send your receipts directly to us.

Phase 2 comes into play from 1st April 2020 and affects ALL UK limited companies subject to paying Corporation Tax and any sole-traders paying Income Tax. Phase 2 of MTD means that all businesses must submit mandatory quarterly updates for both Income and Corporation Tax purposes. This means that, if you’re not yet on accounting software, now is the time.

How do I know if I am MTD ready?

Well, this depends on whether you are using accountancy software. We recommend Xero to all our clients and we’ve successfully moved many businesses from other accounting software over to Xero. This is because Xero is MTD ready. Plus, we hold valid migration and MTD certifications and all members our team are Xero certified advisors.

So, good news if you’re already a client of ours as, by partnering with Xero, we’ve got you covered and fully compliant.

We ensure that all our clients are on accounting software. This is because MTD is making it a legal requirement to store your company data electronically. If you’ve joined us from a previous accountant, you might already be on QuickBooks or FreeAgent. These will be MTD ready but speak to us if you are unsure.

So, what are your actions from this?

Well of course, if you are unsure about anything, just let us know as we would be happy to talk it through.

It is worth utilising our Receipt Bank offer, giving you access to Receipt Bank for FREE. Receipt Bank is a place for you to snap & send any receipts and invoices directly to us. It extracts key data from the invoice or receipt and means you no longer have to save those paper copies, as the electronic copy is an acceptable method for proof of your purchase.

Receipt Bank then integrates with your chosen accounting software, creating a bill and attaching the relevant support documents. This is key, as HMRC will want this proof should you ever be chosen for a tax investigation (speak to us regarding our tax investigation insurance).

Not yet working with us?

We’d love to chat things through to see how our services can benefit you; have you heard about our swanky new Scale-Up package?

Check out our packages now.

Thank you for reading and we hope that it has been useful.

Of course, please do let us have any feedback or suggestions for improvement.

After all, this is for you!